when are property taxes due in illinois 2019

February 14 through Tuesday March 2 2022 2019 Annual Sale. Illinois has one of the highest average property tax rates in the.

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Use this application to.

. In most counties property taxes are paid in two installments usually June 1 and September 1. Check to see if your taxes are past due. County Farm Road Wheaton IL 60187.

Illinois is not extending the filing or payment due dates for tax year 2019 returns for partnerships including nonresident withholding Form IL-1065 which still falls on April 15 2020. If you fail to pay your taxes and the penalty within 30 days the penalty increases to 10 percent of the unpaid tax. Prepare and file 2019 prior year taxes for Illinois state 1799 and federal Free.

Cook County and some other counties use this. County boards may adopt an accelerated billing method by resolution or ordinance. Paying First Installment Property Taxes Early.

July 15 Tax Deadline. Joe Sosnowski R-Rockford filed House Bill 5772 which calls for a 90-day delay without penalties on 2019 property tax payments which come due. COOK COUNTY TREASURERS OFFICE Cook County Treasurers Office.

If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax bill. Election Night Results Contact Calendar Agendas Minutes Maps Employment. Mobile Home Due Date.

June 4 2021 Published. Tax Year 2020 Second. Use this application to.

For those who pay the tax within 30 days of the due date and do not owe back taxes on the same property the penalty is 5 percent of the unpaid tax. In the calendar year 2019 we will be paying real estate taxes for the 2018 year. Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year.

The median property tax in Illinois is 350700 per year for a. It is managed by the local governments including cities counties and taxing districts. Property Tax First Installment Due Date.

Residents wanting information about anything related to property taxes or fees paid to the county can click through the links in this section. 100 Free Federal for Old Tax Returns. Last day to pay taxes to avoid tax sale-500pm - No postmark.

The Illinois Department of Revenue does not administer property tax. Scheduled to be held May 12 through May 18 2022. DuPage County Collector PO.

191 KB File Size. 2nd Installment Due Date. Welcome to Jo Daviess County Illinois.

If you are a taxpayer and would like more information or forms please contact your local county officials. Hamilton County Tax Portal. Real Estate Tax Due Dates.

Collecting property taxes on real estate and mobile homes. 1st Installment Due Date. Illinois taxes average 4705 on a 205000 house the national.

Property Tax Second Installment Due Date. If taxes are not paid after the second installment date in addition to the penalty additional fees may be added. It is important to maintain the countys tax cycle to ensure revenues are available to continue critical services for our residents.

Last day to pay online or over the phone Interactive Voice Response by Credit Card. 173 of home value. Property Reports and Tax Payments.

Tax Year 2021 First Installment Due Date. The median property tax in Illinois is 350700 per year for a home worth the median value of. 2020 - Property Tax Due Dates.

Cook County Treasurers Office - Chicago Illinois. Real Estate Tax Due Dates. Search By Property Index Number PIN Search By Property Address.

View and print Assessed Values including Property Record Cards. September 20 2021 Penalty Begins. The delayed property tax payment enables property owners an additional two 2 months to pay their taxes that were originally due on August 3.

In order to keep Will County residents safe during the unprecedented COVID-19 crisis and offer convenient ways to pay Will County Treasurer Tim Brophy has announced alternate deadlines and methods to pay property taxes. Beginning May 2 2022 through September 30 2022 payments may also be mailed to. Illinois homeowners again paid the nations second-highest property taxes behind New Jersey in the annual survey by WalletHub.

Make and view Tax Payments get current Balance Due. If Taxes Were Sold. Delinquent Property Tax Search.

Taxpayers who do not pay property taxes by the due date receive a penalty. Payments and correspondence may always be mailed directly to the DuPage County Treasurers Office at 421 N. The Illinois Department of Revenue does not administer property tax.

Tax amount varies by county. View and print Tax Statements and Comparison Reports. Will County is located in the northern part of Illinois and is one of the fastest-growing counties in the United States.

Make and view Tax Payments get current Balance Due. Ad Prepare your 2019 state tax 1799. If you have delinquent taxes for Tax Year 2019 they will be offered at the 2019 Annual Tax Sale which begins May 12 2022.

Penalty be assessed for payments made after the due date. Any property owner may pay their second installment of the 2019 property tax by October 1 without any penalties or late fees. Box 4203 Carol Stream IL 60197-4203.

General Information and Resources - Find information. Property tax due dates for 2019 taxes payable in 2020. August 20 2021 Penalty Begins.

Welcome to Ogle County IL. Physical Address 18 N County Street Waukegan IL 60085. Tuesday March 1 2022.

Even if the payment is. 5 Things To Know In Illinois - Across Illinois IL - After being extended three months because of the coronavirus crisis. The county seat.

State law requires a 15 percent interest fee per month on late payments. Tax Year 2021 First Installment Due Date. View Ownership Information including Property Deductions and Transfer History.

The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000.

Increasing Property Taxes Impact Land Owner Returns And Equilibrium Land Values Farmdoc Daily

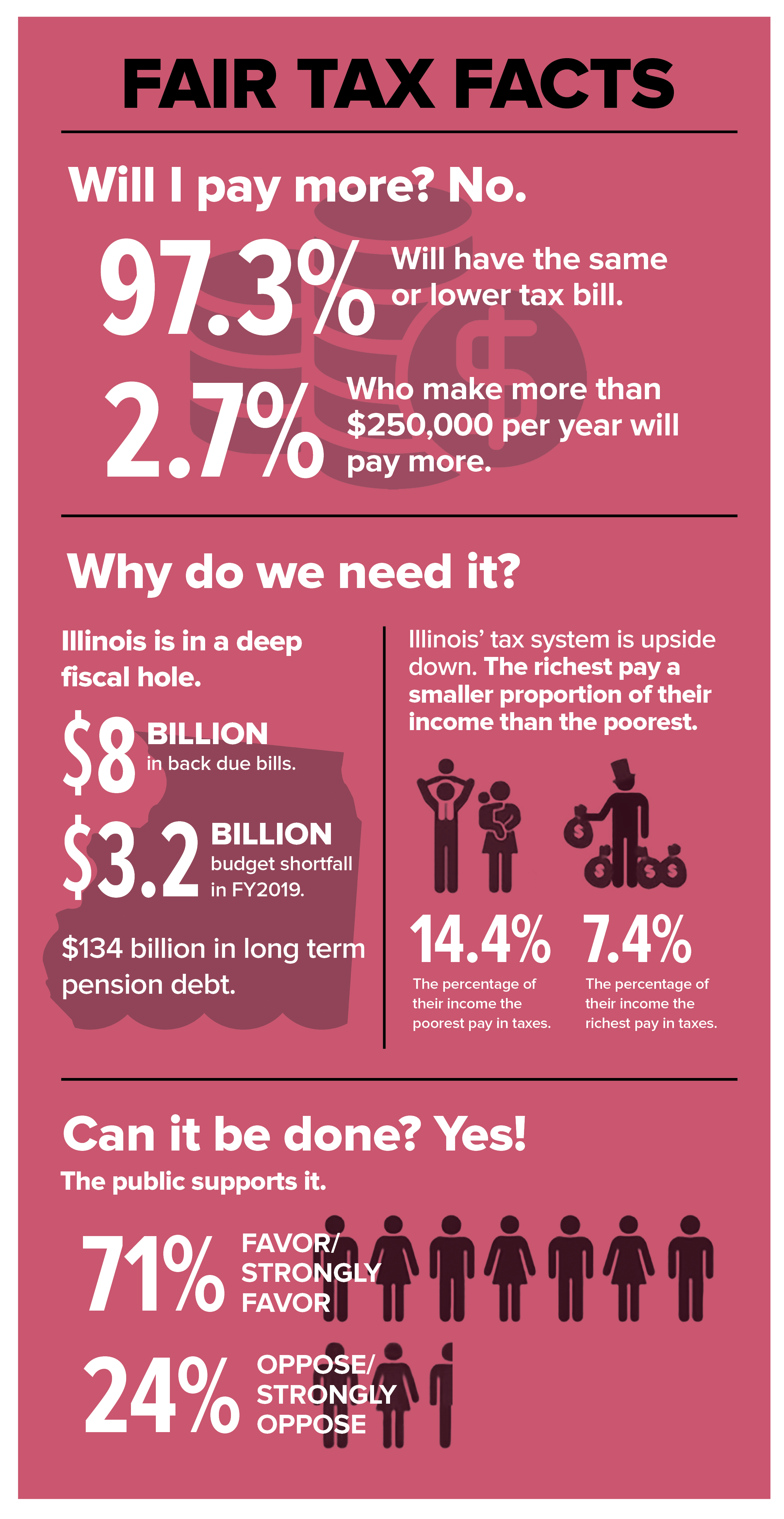

Illinois Income Tax Rate And Brackets 2019

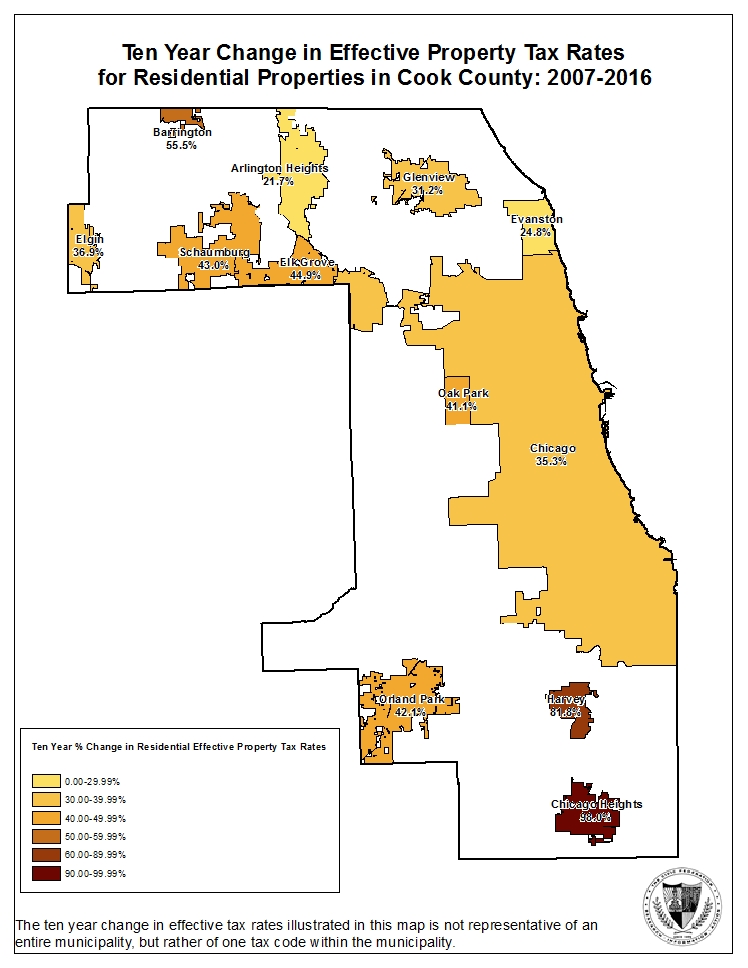

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

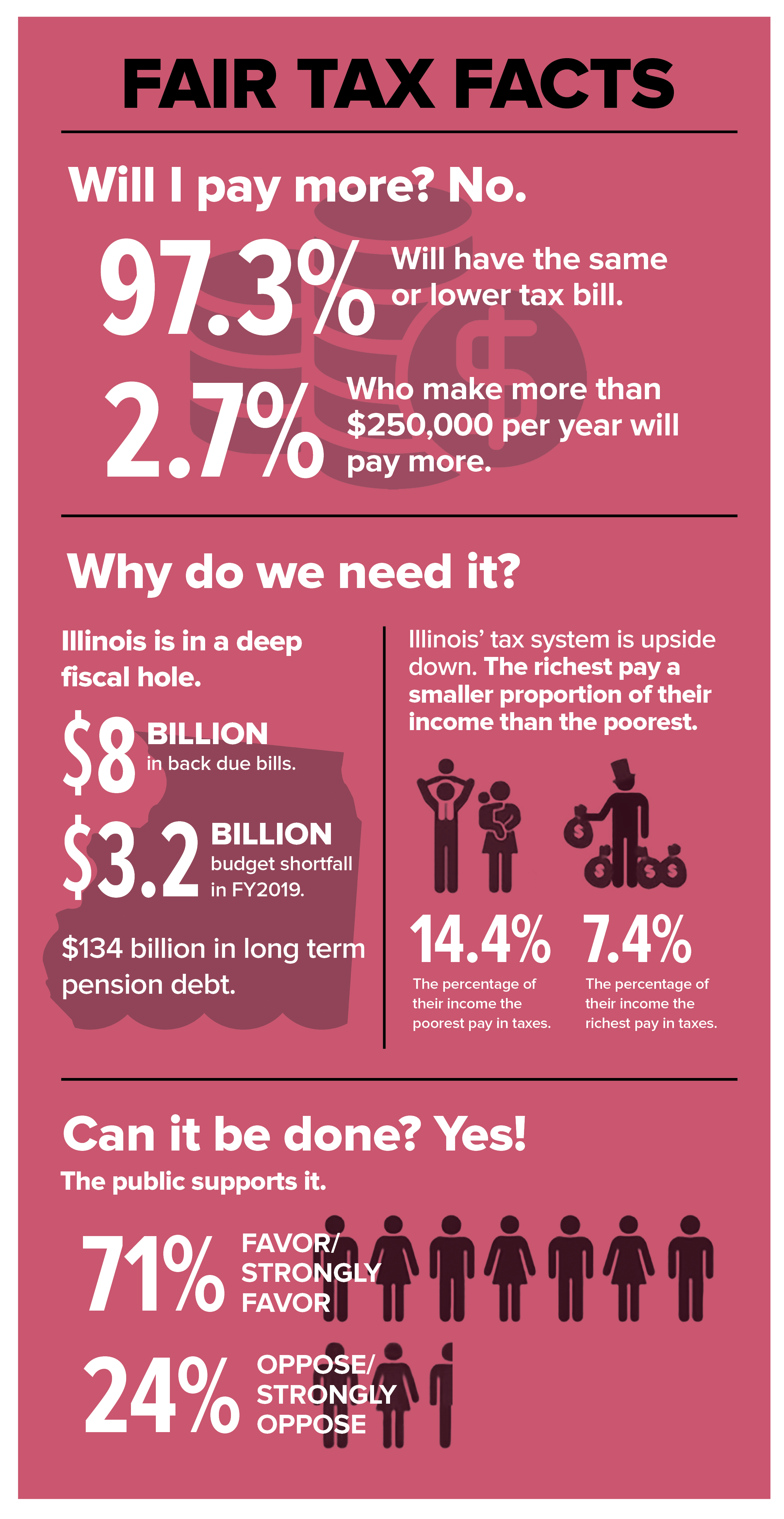

Illinois Needs Fair Tax Reform Afscme 31

Property Tax City Of Decatur Il

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

Property Tax City Of Decatur Il

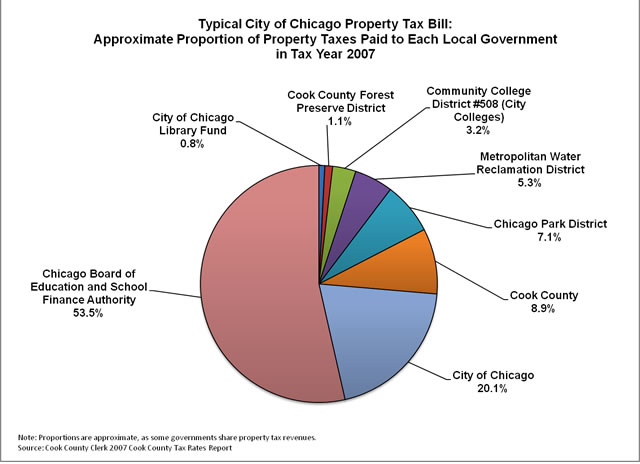

Where Do Your Property Tax Dollars Go The Civic Federation

Cook County Treasurer S Office Chicago Illinois

Cook County Property Tax Bill How To Read Kensington Chicago

Illinois Pritzker Promised To Lower Property Taxes He S Only Made Them Worse Wirepoints Wirepoints

Property Tax Prorations Case Escrow

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

The Cook County Property Tax System Cook County Assessor S Office

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Tax Information Village Of River Forest

The Cook County Property Tax System Cook County Assessor S Office

Illinois Pritzker Promised To Lower Property Taxes He S Only Made Them Worse Wirepoints Wirepoints

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation